per capita tax definition

Standard of Living The standard of living is a term used to describe the level of income necessities luxury and other. Per capita income PCI or average income is the measurement of average income per person in a specific country city or region within a definitive time period.

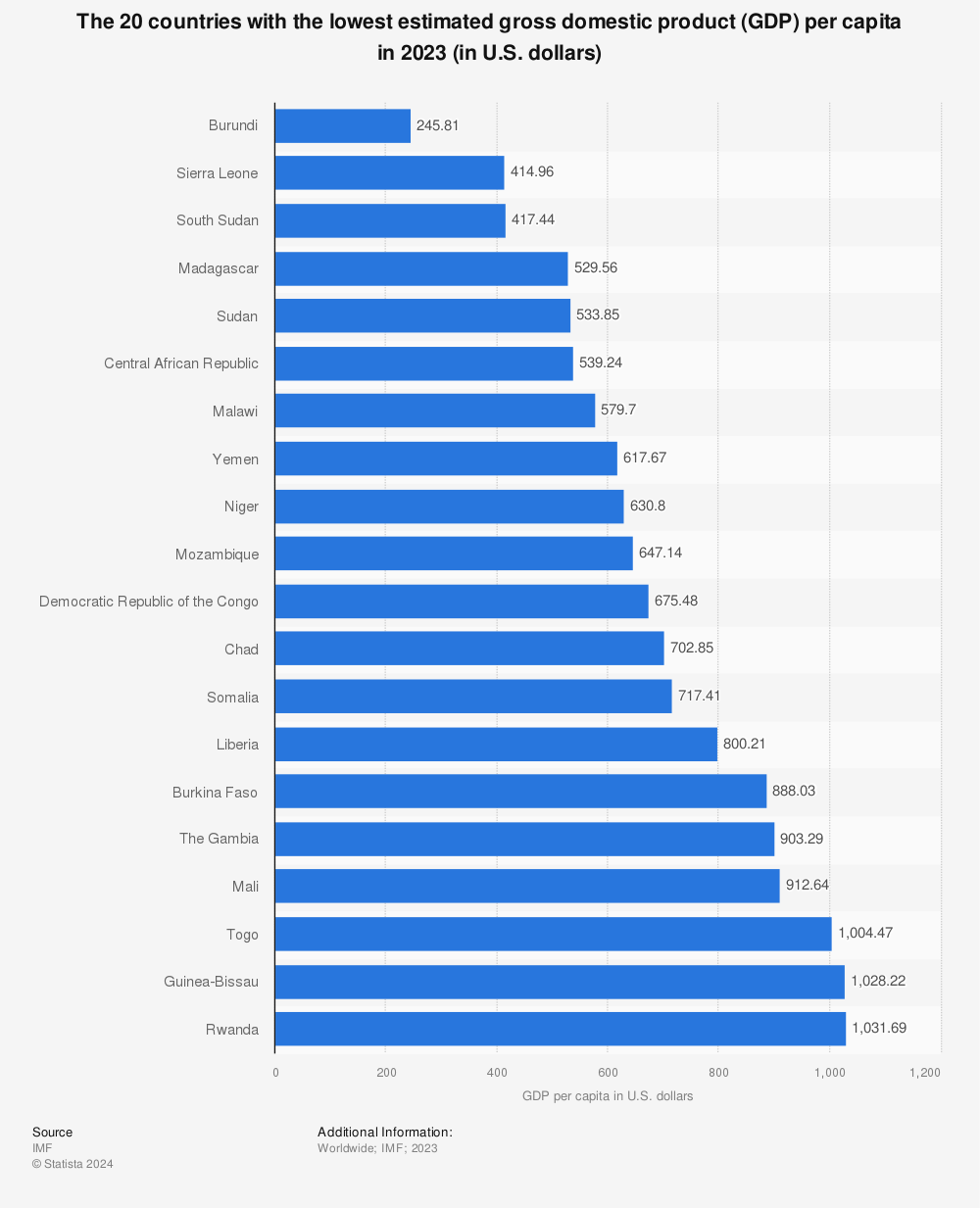

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

Learn how to define income.

. Seven states do not levy an individual income tax. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Per capita GDP is a global measure for.

Do I pay this tax if I rent. Per capita income is an average and this average may not represent the standard of living of the people if the increased national income goes to the few rich instead of giving to the many poor. The term is used in a wide variety of social sciences and statistical research contexts including government statistics economic indicators and built environment studies.

Income per capita is the average earnings per person in a geographic region such as a city state or country. Equally to each individual all property to pass to the descendants per capita used of a method of distributing an esp. Is this tax withheld by my employer.

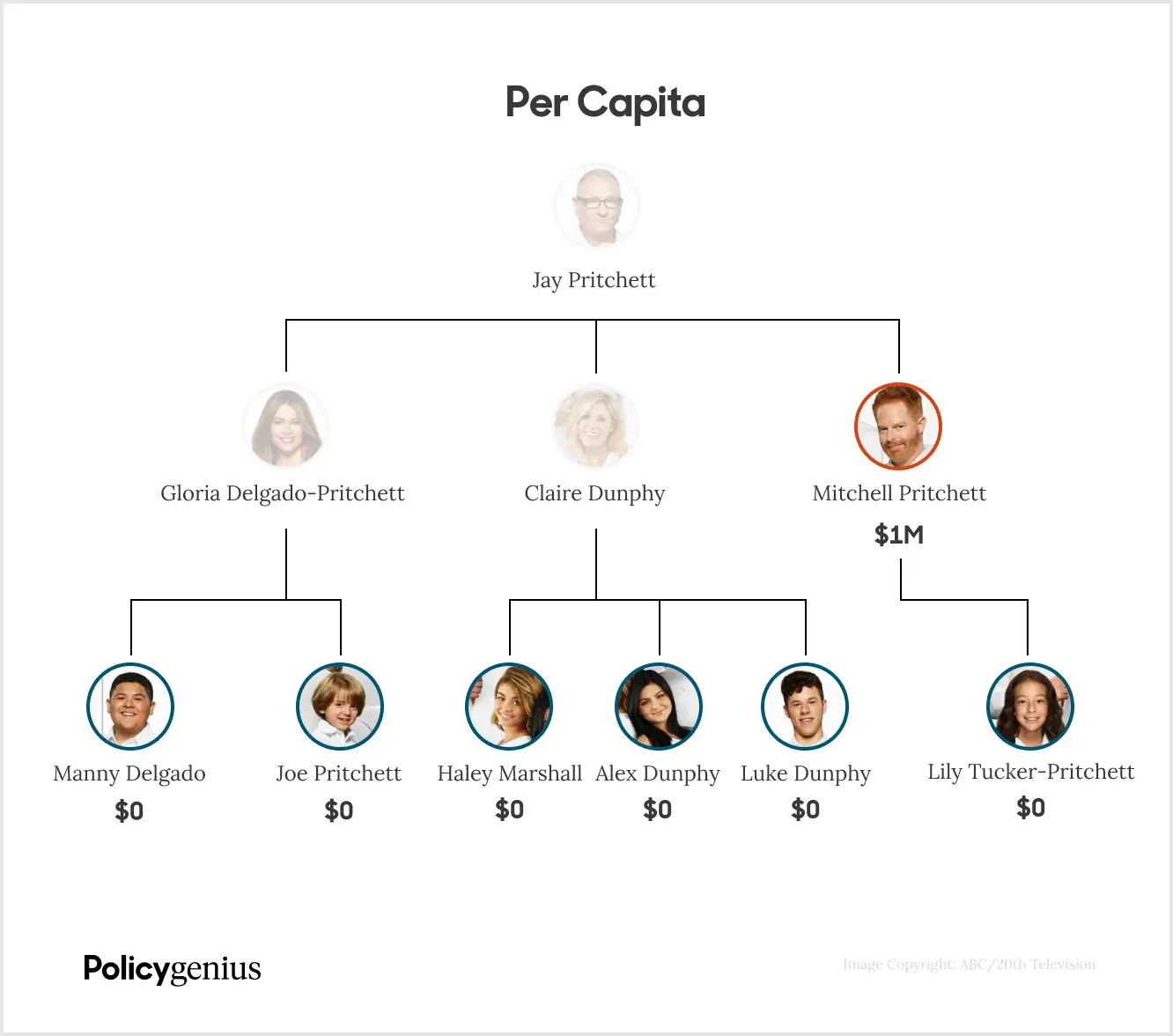

A share wont be created for the deceased beneficiary and all the other beneficiaries shares will be increased accordingly if one of the identified group is deceased. Per capita is a Latin phrase literally meaning by heads or for each head and idiomatically used to mean per person. Normally the Per Capita tax is NOT.

Presbyterians have used per capitaan annual per member apportionment assessed by the General Assembly Book of Order G. In these days of diminishing resources and tight budgets the Presbyterian Church USA continues to seek new and innovative ways to provide ministry and support to mid councils presbyteries and synods across the country. 12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242.

Per capita income does not reflect the standard of living of the people. Calculating per capita entails taking into account a measurement or number amount by which you will then divide by the total population of the group wishing to be analyzed. Intestate estate compare per stirpes NOTE.

Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the district. It is commonly used in the field of statistics in place of saying per person although per caput is. Define Per Capita Payment.

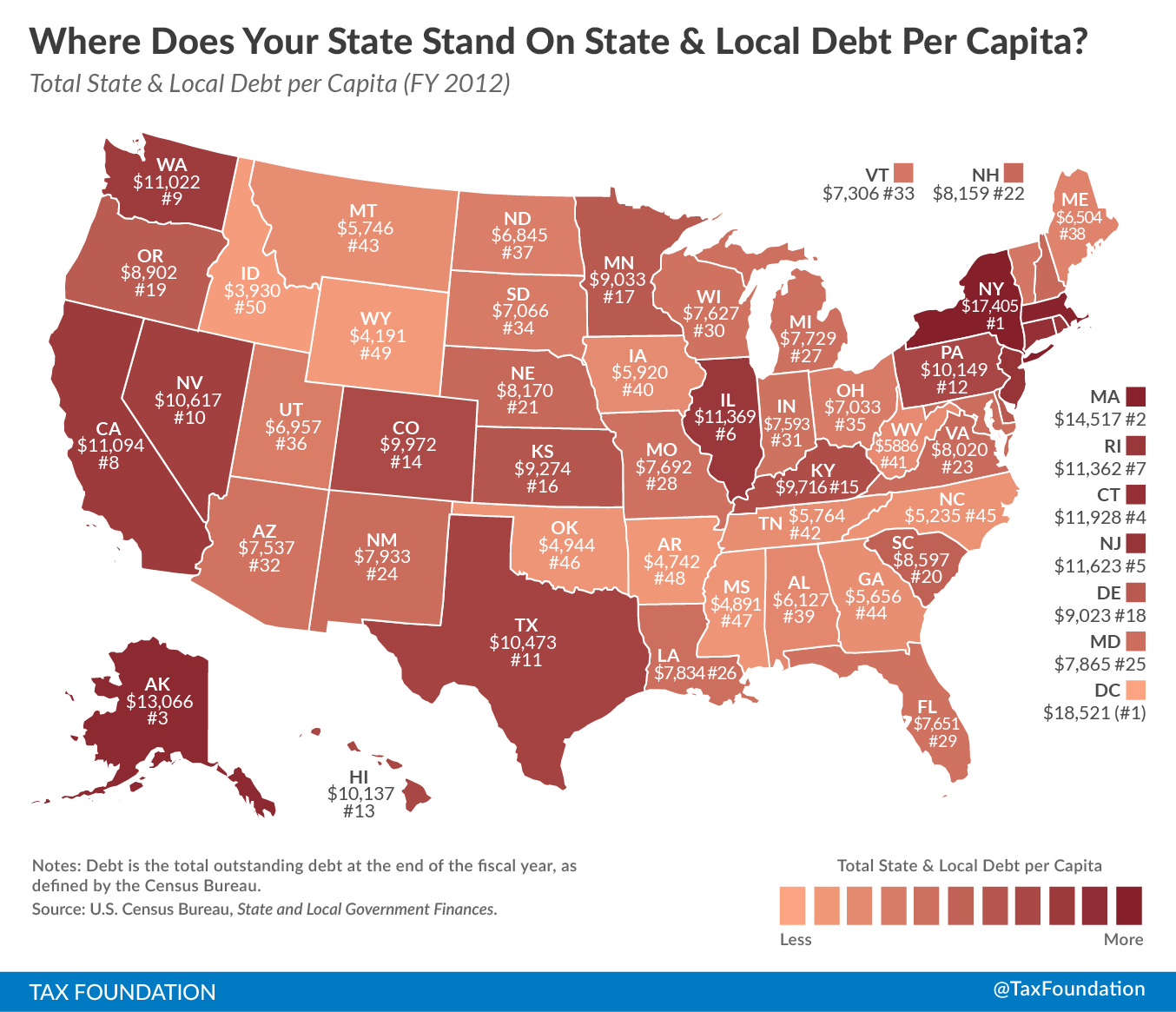

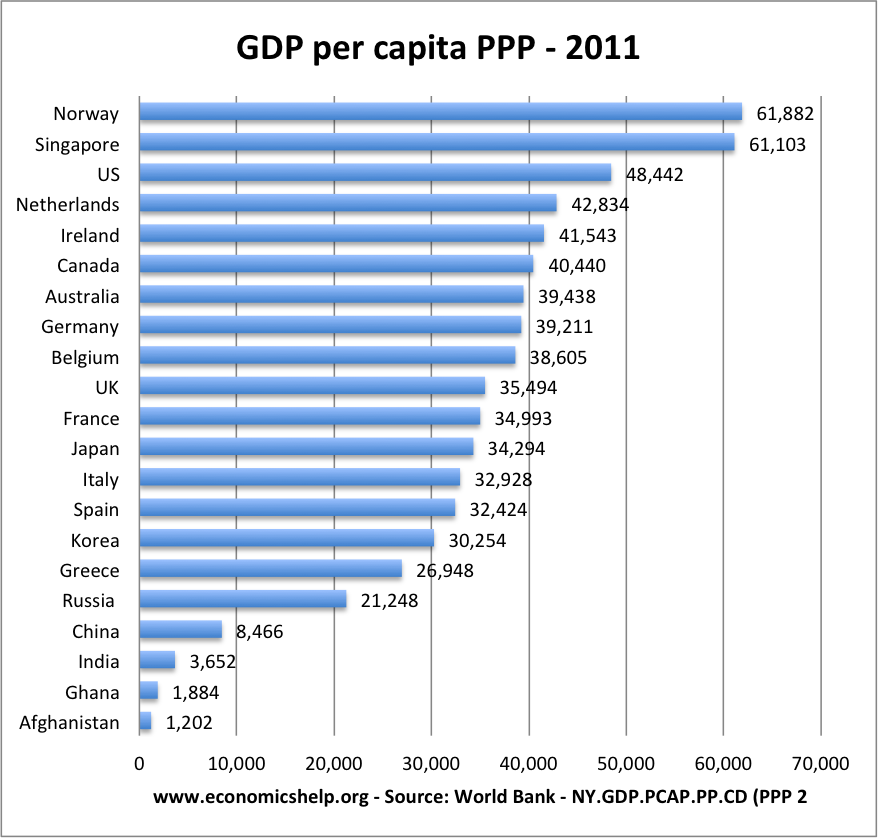

Per capita income as an indicator of development has the following limitations. Per capita gross domestic product GDP measures a countrys economic output per person and is calculated by dividing the GDP of a country by its population. Per capita income is often used to measure a sectors average income and compare the wealth.

Tennessees tax on investment incomeknown as the Hall taxis being phased out and will be fully repealed by tax year 2021. Per unit of population. Per Capita means by head so this tax is commonly called a head tax.

Per capita is the legal term for one of the ways that assets being transferred by your will can be distributed to the beneficiaries of your estate. Steelton Borough Steelton-Highspire School District Paint Borough Delinquent Per Capita only Scalp Level Borough Delinquent Per Capita only Windber Borough delinquent Per Capita only and Shanksville-Stonycreek School District. Per capita distribution of an estate provides each descendant with an equal share of the estates assets regardless of the degree of his or her kinship.

Means that as- pect of a plan which pertains to the in- dividualization of the judgment funds in the form of shares to tribal members or to individual descendants. Per capita adv or adj. On average state and local governments collected 1675 per capita in property taxes nationwide in FY 2018 but collections vary widely from state to state.

What is the Per Capita Tax. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. International Risk Management Institute Inc.

For most areas adult is defined as 18 years of age or older. It is not dependent upon employment. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district.

Under a per capita distribution each person named as beneficiary receives an equal share. It is calculated by dividing the areas total income by its total population. On average state and local governments collected 1164 per capita in individual income.

By or for each individual a high per capita tax burden. Per capita is Latin for by head All the living members of the identified group will receive an equal share if the beneficiaries are to share in a distribution per capita. Alaska Florida Nevada South Dakota Texas Washington and Wyoming.

Per capita income is national income divided by population size. The school district as well as the township or borough in which you reside may levy a per capita tax. The following formula can be used to determine the per capita.

Used primarily in economics PCI utilizes average income to calculate and present the standard of living. Per capita Unit Number of people in a population. Per capita income PCI or total income measures the average income earned per person in a given area city region country etc in a specified year.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Both taxes are due each year and are not duplications. The highest state and local property tax collections per capita are found in the District of Columbia 3740 followed by New Jersey 3378 New Hampshire 3362 Connecticut 3107 New York 3025 and.

How Is Tax Liability Calculated Common Tax Questions Answered

Information About Per Capita Taxes York Adams Tax Bureau

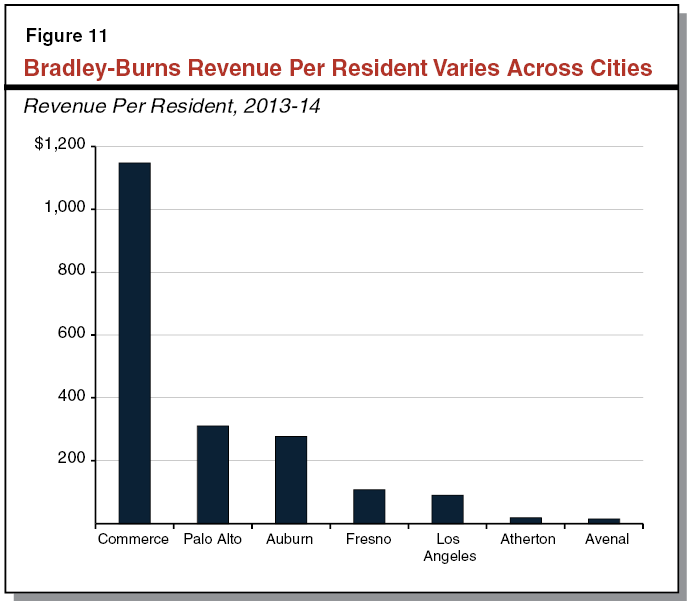

Understanding California S Sales Tax

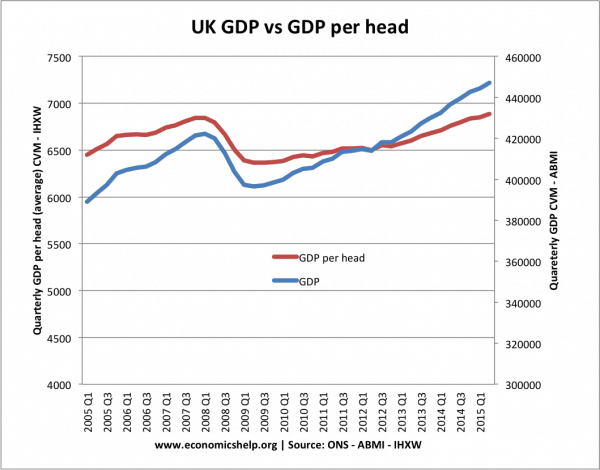

Real Gdp Per Capita Economics Help

Property Tax Definition Learn About Property Taxes Taxedu

Per Capita Definition Formula Examples And Limitations Boycewire

Property Tax Definition Learn About Property Taxes Taxedu

Per Stirpes Vs Per Capita Death Benefit Policygenius

Property Tax Definition Learn About Property Taxes Taxedu

Pennlive Letters To The Editor

Real Gdp Per Capita Economics Help

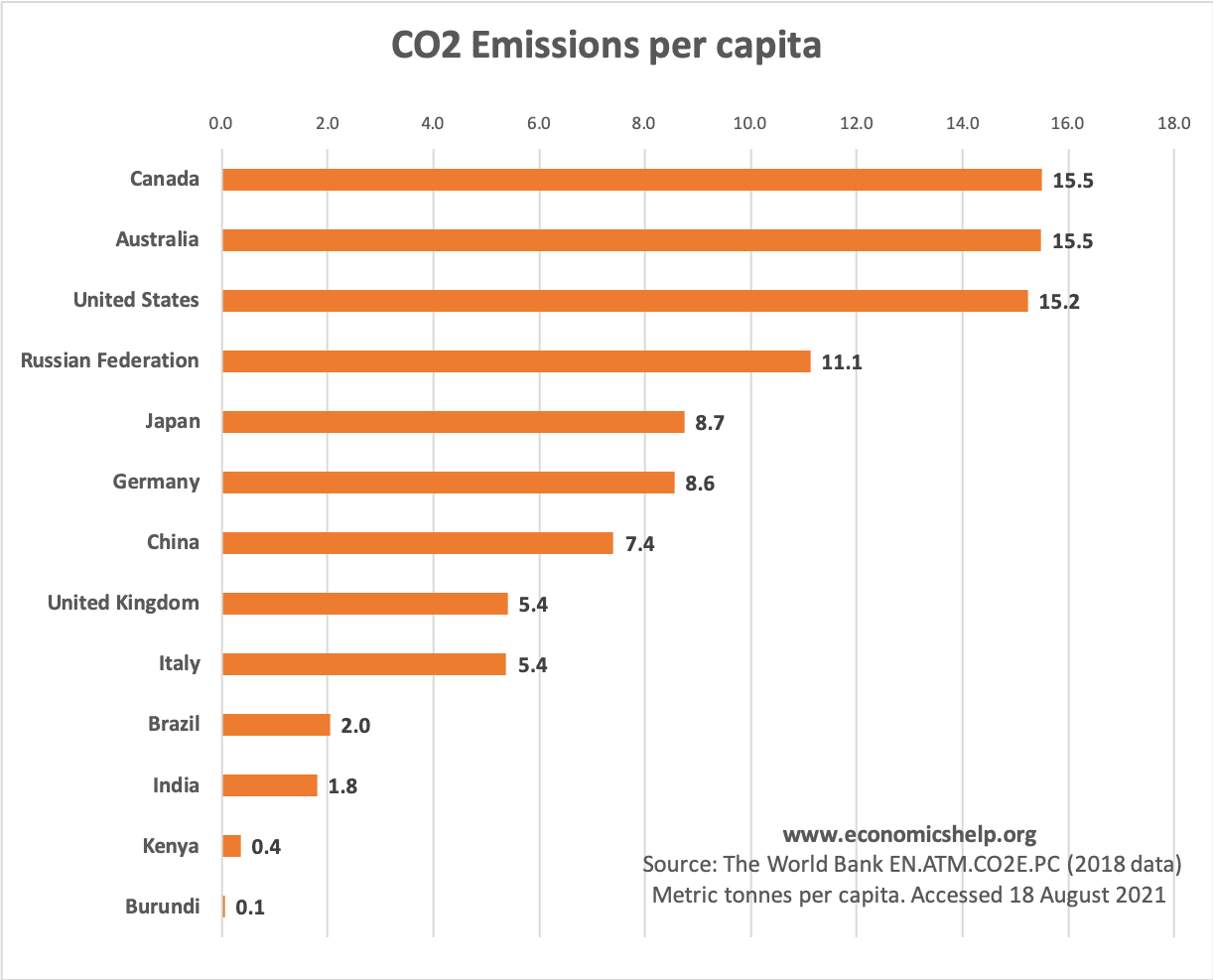

Top Co2 Polluters And Highest Per Capita Economics Help

/GettyImages-545863985-e964b845dce944dfb2b94153aab83a7a.jpg)